Time to end the market experiment in the NHS?

In this report we explore the evidence about which NHS contracts are being tendered, who is winning them and how these trends form part of the new direction the NHS is now taking. Our data is based largely on a process of analysing published awards, a data base that we have compiled from observations over the last 4 years.

We also review the catalogue of problems that have emerged in the various types of outsourcing that have been tried, as part of the NHS market experiment. Some of these failures have undoubtedly influenced the current changes in strategic approach and led to the widely supported view that this experiment should end.

It is time to act on the knowledge that has been built up about how outsourcing in the NHS can negatively impact upon patients, staff, the level of resources and other NHS services. This evidence makes a compelling case and we would therefore urge the government to repeal its competition legislation and focus on building an adequate level of publicly-provided NHS services.

Paul Evans

Director, NHS Support Federation

Full report available here.

Executive Summary

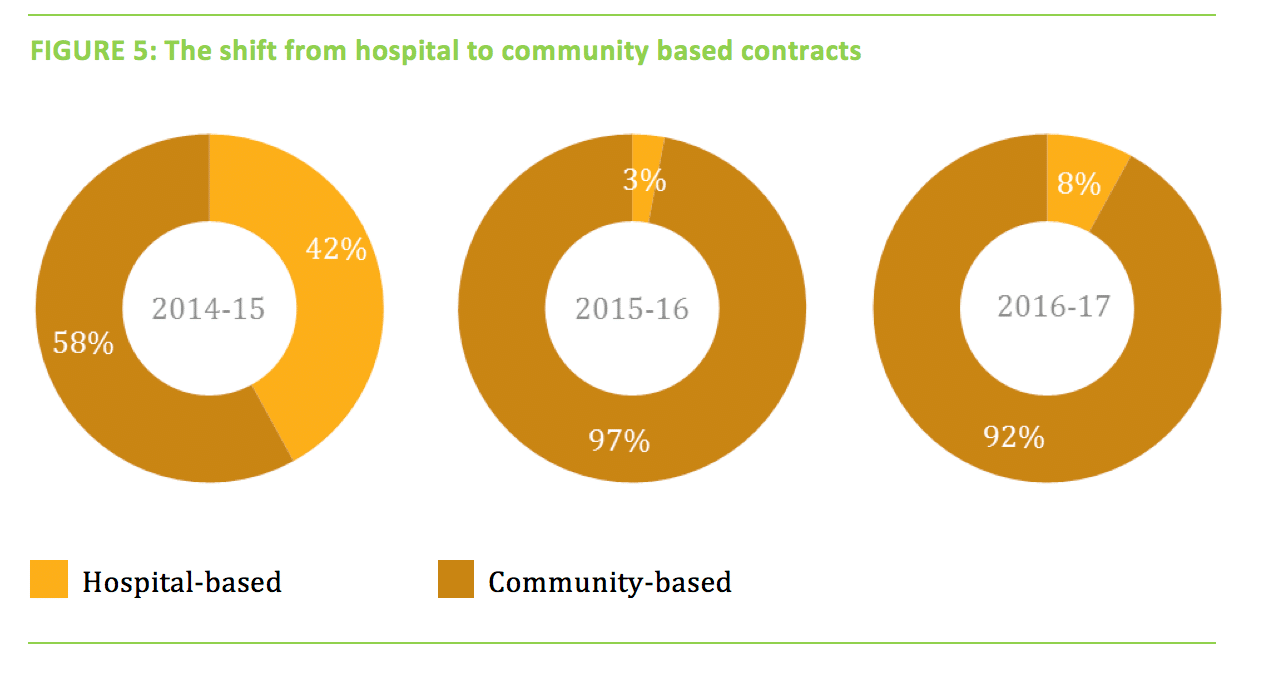

1. Activity in the market for NHS contracts remains high despite a signaled shift away from competition by the Chief Executive of the NHS. Over the last year (Apr 2016/17) £7.1 billion worth of NHS clinical contracts has been awarded through the tendering process. This is on a par with the preceding year. £1.6bn worth of NHS contracts were advertised in the first quarter of the current financial year (2017/18); which brings the total value of contracts awarded through the market to around £25bn, since the Health and Social Care Act (2012) came into force. The number of high value clinical contracts that have been advertised, worth over £100 million pounds each, has almost doubled in the last year, rising from 11 to 20, of which eight were won by the private sector.

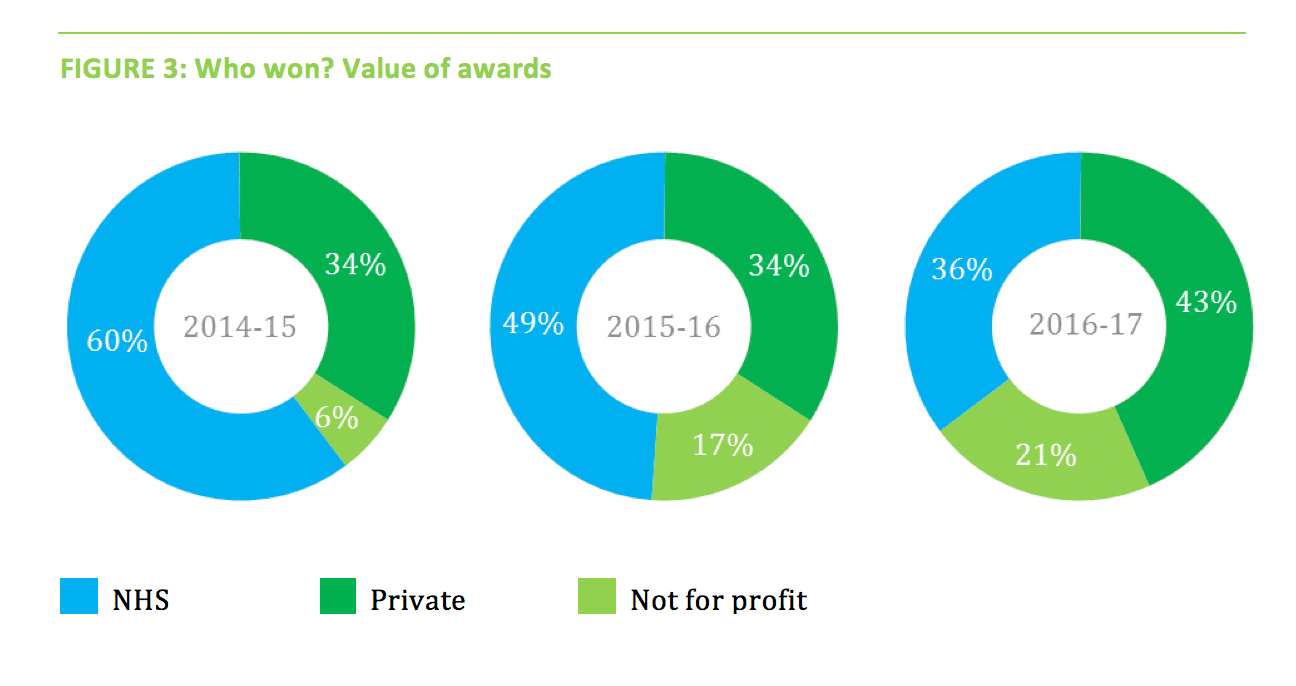

2. The private sector share of NHS contracts is rising, as they focus increasingly on growing opportunities to provide community health services. For-profit companies won £3.1 billion worth of new contracts in the last year (16/17). This was 43% of the total value of awards advertised and their share has risen from 34% (15/16). Companies are turning their attention to new opportunities offered by the intention to treat more patients in the community and less in hospital, an NHS wide policy. Circle – the company that walked away from a contract to run the NHS Hinchingbrooke hospital, is now investing in intermediate care, intending to offer care beds outside hospital to look after NHS patients that hospitals want to discharge.

3. Virgin Care has been the most successful company in winning NHS clinical contracts - mostly to provide community healthcare, picking up over £1bn worth of NHS awards in 2016/17. Its latest awards are a £355m contract to provide children’s health services in Essex and a £65m award to run community health in West Lancashire. In each case the company is taking over services from the NHS and non-profit making providers. Virgin care is now the dominant private provider in the NHS market – winning a third of the total value of contracts won by non-NHS providers over the last year. The number of services the company provides to the NHS has risen from 230 to 400 over last 12 months, according to its website.

4. There is compelling evidence that the competition regulations under section 75 of the Health and Social Care Act (2012) - introduced in April 2013 are dysfunctional and have resulted in numerous failed outsourcing projects. In a growing number of instances NHS organisations are starting to game-play the procurement rules to avoid open competition. At the same time private companies are using the courts and competition law to try to maintain their access to NHS contracts. Competitive tendering was put at the heart of healthcare planning by the Health and Social Care Act (2012) and was a catalyst for numerous experiments with the outsourcing of NHS clinical services. Just five years on there is now a substantial body of examples to show how outsourcing arranged under these procurement regulations often results in contract failures and serious breakdowns in the delivery and quality of care. All at a cost to patients, staff, NHS services and the tax payer.

5. There is a growing consensus that the competition framework needs to be replaced and yet party-political concerns are preventing it, a situation which will leave the NHS with a failing procurement model and could result in a further £10bn in NHS contracts going to the private sector over the next 3 years. In March, NHS Chief Simon Stevens confirmed that the arrival of STPs would “effectively end the purchaser-provider split for the first time since 1990”. This represented a major shift in policy away from the themes of competition and patient choice - the Lansley era. The current health secretary, Jeremy Hunt also backs the need for new legislation, an intention outlined in the Conservative’s election manifesto. After the election however, he acknowledged that the government’s precarious Parliamentary situation had effectively removed the possibility. This means that the current legal framework around tendering will remain in place, which on current trends will lead to the private sector winning a further £10bn of NHS clinical contracts over the next 3 years.

6. Accountable Care Systems have been flagged as the new model for local healthcare planning in the NHS. The future role for private companies has not been clarified, but commercial opportunities are far from being capped. Only a handful of examples of new models of care are fully developed and so far the private sector have not been bidding for the multi-billion contracts. However, in Nottingham, Capita and Centene have been employed to help develop the Accountable Care System. Healthcare companies are also well placed to bid to market their cost-saving solutions to ACOs, who will operate with capped budgets. Virgin and Care UK have already landed over £2bn worth of NHS business and the government has not signaled that it will inhibit this kind of sub-contracting or outsourcing. An even bigger role for business is possible though. The ACO contract that has been drawn up by NHS England does not preclude the private sector from bidding for them, although the major players in the international market, companies like United Health and Humana and Centene could will want to assess the business risk.

7. The scale of private sector involvement in the NHS is regularly downplayed in departmental and ministerial statements, but the H&SC Act has ensured that non-NHS providers have been able to establish a substantial foothold in local NHS provision. A survey of CCG accounts for 2016/17 by the NHS Support Federation shows that these commissioners spend around 15% of their operating expenses on employing private companies and charities to deliver healthcare to CCGs. This is higher than the 11% figure shown in the national accounts - which expresses the spending on non-NHS organisations as a % of the overall DEL (Departmental Expenditure Limit). The value of the contracts awarded through market procurement is now seven times higher than in 2013.

8. Over the last 3 years the types of services being tendered has shifted almost entirely towards those that are delivered in community settings, outside of hospitals. The private sector and charities win a majority share of these contracts. Three years ago, hospital based care contracts accounted for 40% of the value of those clinical services put up for tender. Services delivered in hospital now account for less than 10% of the value of tenders, with the vast majority being contracts delivered in the community. Contracts to deliver services in the community cover a wide range of services including; out of hours GP care, community nursing, public health and children’s health services. In the last year the private sector and charities won over 60% of the value of these contracts.